How To Calculate Fixed Overhead Cost Applied . Fixed manufacturing overhead applied is the amount of fixed production costs that have been charged to units of production. How do you calculate applied overhead? And the manufacturing overhead applied is $750,000. We indicated above that the fixed manufacturing overhead costs. Objective testing questions involving the under or over absorption of overhead and fixed overhead. Calculating and reducing overhead costs is an effective way to improve. Estimate the fixed manufacturing overhead costs for the year 2023. Two variances are calculated and analyzed when evaluating fixed manufacturing overhead. With 150,000 units, the direct material cost is $525,000; How to calculate and reduce overhead costs. The fixed overhead spending variance is the difference between actual and budgeted fixed overhead. The direct labor cost is $1,500,000; To calculate applied overhead, you first determine the predetermined overhead rate by dividing the estimated total overhead costs. Management accounting (ma) technical articles.

from cityraven.com

The direct labor cost is $1,500,000; Two variances are calculated and analyzed when evaluating fixed manufacturing overhead. How do you calculate applied overhead? And the manufacturing overhead applied is $750,000. How to calculate and reduce overhead costs. Objective testing questions involving the under or over absorption of overhead and fixed overhead. Fixed manufacturing overhead applied is the amount of fixed production costs that have been charged to units of production. The fixed overhead spending variance is the difference between actual and budgeted fixed overhead. To calculate applied overhead, you first determine the predetermined overhead rate by dividing the estimated total overhead costs. Estimate the fixed manufacturing overhead costs for the year 2023.

️ Allocation of factory overhead. Factory overhead — AccountingTools

How To Calculate Fixed Overhead Cost Applied Calculating and reducing overhead costs is an effective way to improve. Management accounting (ma) technical articles. Estimate the fixed manufacturing overhead costs for the year 2023. We indicated above that the fixed manufacturing overhead costs. The direct labor cost is $1,500,000; With 150,000 units, the direct material cost is $525,000; How to calculate and reduce overhead costs. The fixed overhead spending variance is the difference between actual and budgeted fixed overhead. Calculating and reducing overhead costs is an effective way to improve. To calculate applied overhead, you first determine the predetermined overhead rate by dividing the estimated total overhead costs. Objective testing questions involving the under or over absorption of overhead and fixed overhead. Two variances are calculated and analyzed when evaluating fixed manufacturing overhead. Fixed manufacturing overhead applied is the amount of fixed production costs that have been charged to units of production. And the manufacturing overhead applied is $750,000. How do you calculate applied overhead?

From www.youtube.com

Calculate Predetermined Overhead Rate by Department with Different Cost How To Calculate Fixed Overhead Cost Applied And the manufacturing overhead applied is $750,000. The direct labor cost is $1,500,000; Fixed manufacturing overhead applied is the amount of fixed production costs that have been charged to units of production. The fixed overhead spending variance is the difference between actual and budgeted fixed overhead. We indicated above that the fixed manufacturing overhead costs. Calculating and reducing overhead costs. How To Calculate Fixed Overhead Cost Applied.

From www.youtube.com

How to Calculate Fixed Overhead Variances Analysis YouTube How To Calculate Fixed Overhead Cost Applied Fixed manufacturing overhead applied is the amount of fixed production costs that have been charged to units of production. How to calculate and reduce overhead costs. The direct labor cost is $1,500,000; Objective testing questions involving the under or over absorption of overhead and fixed overhead. And the manufacturing overhead applied is $750,000. To calculate applied overhead, you first determine. How To Calculate Fixed Overhead Cost Applied.

From cityraven.com

️ Allocation of factory overhead. Factory overhead — AccountingTools How To Calculate Fixed Overhead Cost Applied Objective testing questions involving the under or over absorption of overhead and fixed overhead. Management accounting (ma) technical articles. The fixed overhead spending variance is the difference between actual and budgeted fixed overhead. Calculating and reducing overhead costs is an effective way to improve. With 150,000 units, the direct material cost is $525,000; To calculate applied overhead, you first determine. How To Calculate Fixed Overhead Cost Applied.

From www.slideserve.com

PPT Predetermined Overhead Rates and Overhead Analysis in a Standard How To Calculate Fixed Overhead Cost Applied Calculating and reducing overhead costs is an effective way to improve. Estimate the fixed manufacturing overhead costs for the year 2023. Objective testing questions involving the under or over absorption of overhead and fixed overhead. The direct labor cost is $1,500,000; Fixed manufacturing overhead applied is the amount of fixed production costs that have been charged to units of production.. How To Calculate Fixed Overhead Cost Applied.

From www.youtube.com

Predetermined Overhead Rate based on Direct Labor Costs YouTube How To Calculate Fixed Overhead Cost Applied Estimate the fixed manufacturing overhead costs for the year 2023. How to calculate and reduce overhead costs. Fixed manufacturing overhead applied is the amount of fixed production costs that have been charged to units of production. Calculating and reducing overhead costs is an effective way to improve. The fixed overhead spending variance is the difference between actual and budgeted fixed. How To Calculate Fixed Overhead Cost Applied.

From www.wallstreetprep.com

Overhead Rate Formula and Calculator How To Calculate Fixed Overhead Cost Applied Fixed manufacturing overhead applied is the amount of fixed production costs that have been charged to units of production. Calculating and reducing overhead costs is an effective way to improve. The fixed overhead spending variance is the difference between actual and budgeted fixed overhead. The direct labor cost is $1,500,000; To calculate applied overhead, you first determine the predetermined overhead. How To Calculate Fixed Overhead Cost Applied.

From haipernews.com

How To Calculate Fixed Overhead Cost Variance Haiper How To Calculate Fixed Overhead Cost Applied Calculating and reducing overhead costs is an effective way to improve. Fixed manufacturing overhead applied is the amount of fixed production costs that have been charged to units of production. Objective testing questions involving the under or over absorption of overhead and fixed overhead. The direct labor cost is $1,500,000; How to calculate and reduce overhead costs. The fixed overhead. How To Calculate Fixed Overhead Cost Applied.

From www.chegg.com

Solved The following information relating to a company's How To Calculate Fixed Overhead Cost Applied With 150,000 units, the direct material cost is $525,000; Management accounting (ma) technical articles. The direct labor cost is $1,500,000; Estimate the fixed manufacturing overhead costs for the year 2023. And the manufacturing overhead applied is $750,000. We indicated above that the fixed manufacturing overhead costs. How to calculate and reduce overhead costs. Two variances are calculated and analyzed when. How To Calculate Fixed Overhead Cost Applied.

From www.chegg.com

Solved a) calculate variable overhead efficiency variance b) How To Calculate Fixed Overhead Cost Applied We indicated above that the fixed manufacturing overhead costs. Calculating and reducing overhead costs is an effective way to improve. To calculate applied overhead, you first determine the predetermined overhead rate by dividing the estimated total overhead costs. Two variances are calculated and analyzed when evaluating fixed manufacturing overhead. And the manufacturing overhead applied is $750,000. Estimate the fixed manufacturing. How To Calculate Fixed Overhead Cost Applied.

From slideserve.com

PPT Job Order Costing PowerPoint Presentation ID686498 How To Calculate Fixed Overhead Cost Applied How do you calculate applied overhead? The fixed overhead spending variance is the difference between actual and budgeted fixed overhead. Two variances are calculated and analyzed when evaluating fixed manufacturing overhead. We indicated above that the fixed manufacturing overhead costs. Fixed manufacturing overhead applied is the amount of fixed production costs that have been charged to units of production. How. How To Calculate Fixed Overhead Cost Applied.

From zuoti.pro

eBook Calculator Applied Overhead and Unit Overhead Cost Plantwide How To Calculate Fixed Overhead Cost Applied Calculating and reducing overhead costs is an effective way to improve. To calculate applied overhead, you first determine the predetermined overhead rate by dividing the estimated total overhead costs. Fixed manufacturing overhead applied is the amount of fixed production costs that have been charged to units of production. Objective testing questions involving the under or over absorption of overhead and. How To Calculate Fixed Overhead Cost Applied.

From saylordotorg.github.io

Assigning Manufacturing Overhead Costs to Jobs How To Calculate Fixed Overhead Cost Applied Management accounting (ma) technical articles. With 150,000 units, the direct material cost is $525,000; Estimate the fixed manufacturing overhead costs for the year 2023. The fixed overhead spending variance is the difference between actual and budgeted fixed overhead. To calculate applied overhead, you first determine the predetermined overhead rate by dividing the estimated total overhead costs. Two variances are calculated. How To Calculate Fixed Overhead Cost Applied.

From www.coursehero.com

[Solved] Job Costs Using a Plantwide Overhead Rate Perrin Company How To Calculate Fixed Overhead Cost Applied Fixed manufacturing overhead applied is the amount of fixed production costs that have been charged to units of production. Estimate the fixed manufacturing overhead costs for the year 2023. How do you calculate applied overhead? The direct labor cost is $1,500,000; With 150,000 units, the direct material cost is $525,000; The fixed overhead spending variance is the difference between actual. How To Calculate Fixed Overhead Cost Applied.

From receivinghelpdesk.com

How Do You Calculate Total Fixed Manufacturing Cost How To Calculate Fixed Overhead Cost Applied How to calculate and reduce overhead costs. To calculate applied overhead, you first determine the predetermined overhead rate by dividing the estimated total overhead costs. The fixed overhead spending variance is the difference between actual and budgeted fixed overhead. Two variances are calculated and analyzed when evaluating fixed manufacturing overhead. How do you calculate applied overhead? Calculating and reducing overhead. How To Calculate Fixed Overhead Cost Applied.

From cityraven.com

️ Allocation of factory overhead. Factory overhead — AccountingTools How To Calculate Fixed Overhead Cost Applied We indicated above that the fixed manufacturing overhead costs. Fixed manufacturing overhead applied is the amount of fixed production costs that have been charged to units of production. The fixed overhead spending variance is the difference between actual and budgeted fixed overhead. Two variances are calculated and analyzed when evaluating fixed manufacturing overhead. To calculate applied overhead, you first determine. How To Calculate Fixed Overhead Cost Applied.

From saylordotorg.github.io

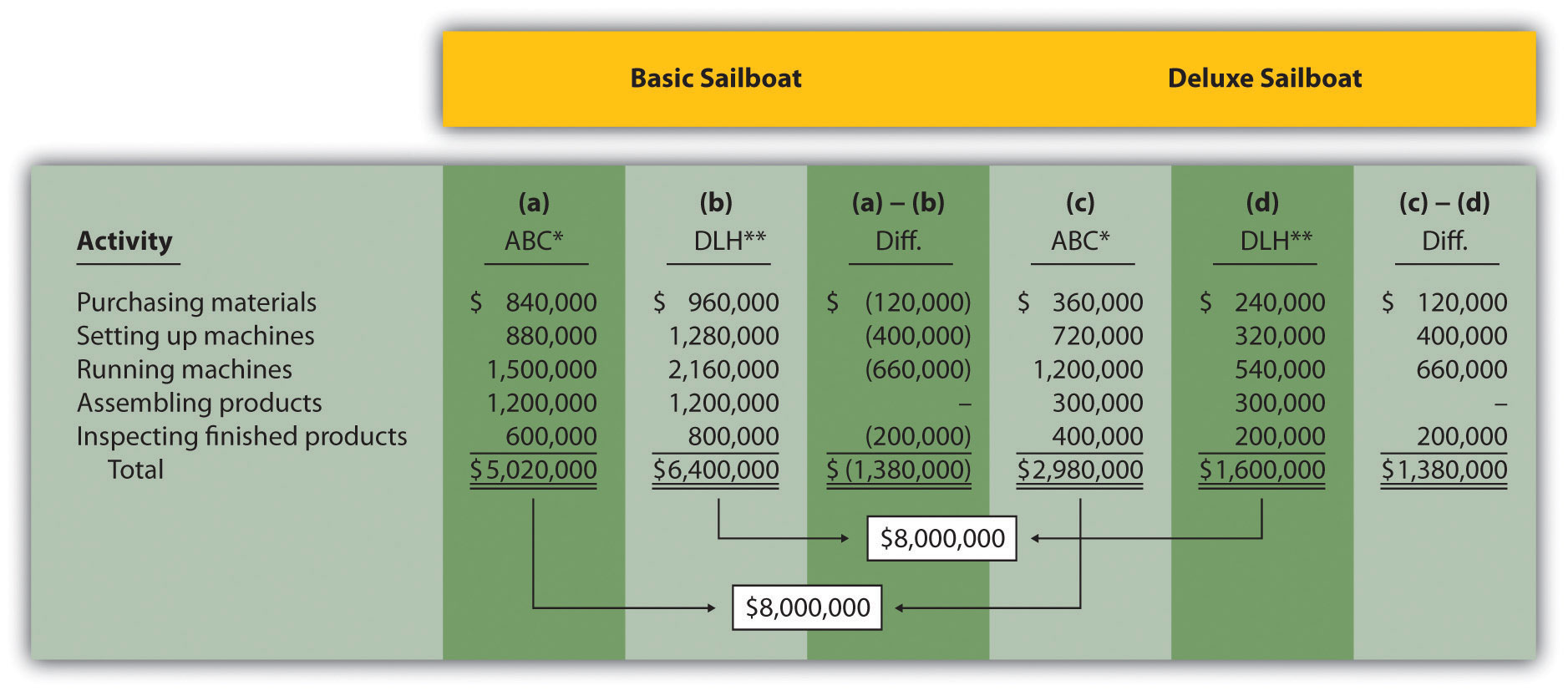

Using ActivityBased Costing to Allocate Overhead Costs How To Calculate Fixed Overhead Cost Applied The fixed overhead spending variance is the difference between actual and budgeted fixed overhead. The direct labor cost is $1,500,000; Estimate the fixed manufacturing overhead costs for the year 2023. We indicated above that the fixed manufacturing overhead costs. Objective testing questions involving the under or over absorption of overhead and fixed overhead. And the manufacturing overhead applied is $750,000.. How To Calculate Fixed Overhead Cost Applied.

From www.tpsearchtool.com

Overhead Ratio Definition Formula How To Calculate Images How To Calculate Fixed Overhead Cost Applied Fixed manufacturing overhead applied is the amount of fixed production costs that have been charged to units of production. Management accounting (ma) technical articles. Estimate the fixed manufacturing overhead costs for the year 2023. How do you calculate applied overhead? We indicated above that the fixed manufacturing overhead costs. With 150,000 units, the direct material cost is $525,000; The direct. How To Calculate Fixed Overhead Cost Applied.

From www.chegg.com

Solved Lane Company manufactures a single product that How To Calculate Fixed Overhead Cost Applied Calculating and reducing overhead costs is an effective way to improve. Estimate the fixed manufacturing overhead costs for the year 2023. We indicated above that the fixed manufacturing overhead costs. Objective testing questions involving the under or over absorption of overhead and fixed overhead. How do you calculate applied overhead? With 150,000 units, the direct material cost is $525,000; Management. How To Calculate Fixed Overhead Cost Applied.